Most of us are the recipients of numerous sources of information pertaining to taxes and a number of newsletters cover tax topics. However, it is important to realize that tax planning is not a once in a year, do at the very end of year, transaction-by-transaction sort of endeavor. Rather it is something that should be considered in every aspect of the way you do business and in addition, this basic structure of the business should always be considered from a tax perspective.

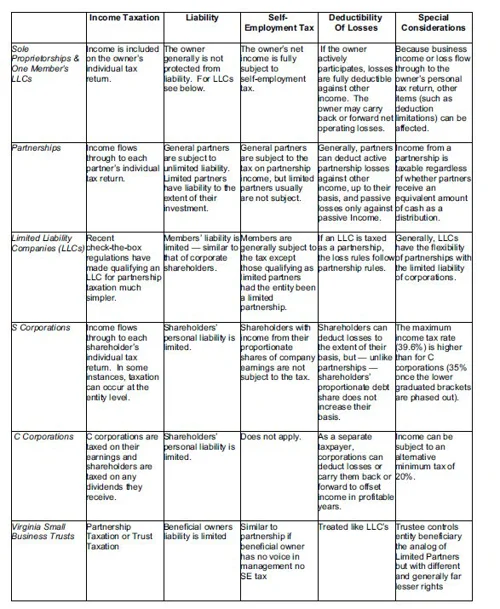

Enclosed within this article is a table that compares and contrasts six forms of doing business. Each one of them has advantages and disadvantages from a variety of perspectives including the tax perspective. It is important to realize that the appropriate entity of a given business should be looked at with great care. Recent studies suggest that all of these entities are viable under the right circumstances can result in the lowest possible tax for an individual.

Selecting the type of entity becomes critical and is heavily dependent on the facts and circumstances of a given situation. Notwithstanding the conventional wisdom, which by the way does change from year to year, all of these types of organizations have their place in a viable tax structure for a given individual. But which of these entities would be selected is very much dependent on a number of factors.

One clear trend is demonstrated by the movement away from sole proprietorships that do not afford any protection from liability with respect to the business. However, a one member LLC will give you proprietorship tax treatment while preserving limited liability. Limitation of liability and using Limited Liability entities to protect assets is becoming the number one way to safeguard property in a more and more litigious society.

A detailed analysis of the most recent tax data indicates that in fact “C” corporations, where the circumstances are correct, are the right choice of entity with respect to the form of organization for a business. As is always the case, it is important to examine with care the facts and circumstances and tailor the entity to be selected carefully according to the needs of the business and the goals and objectives of its owners. Wolcott Rivers Gates can help you make these choices.

This article does not constitute legal advice. Readers should consult their legal advisors prior to acting on any information set forth in this article.

Circular 230 Disclosure: This communication is not a tax opinion, and does not constitute tax advice. Pursuant to Internal Revenue Service regulations, this communication is not intended or written to be used by a taxpayer for the purposes of avoiding tax penalties that may be imposed on the taxpayer.